Imagine staring down the barrel of the tax deadline, feeling the sweat bead on your forehead. You're not alone! Many taxpayers face this yearly pressure. The good news? There's a way to buy yourself some breathing room. This article provides a comprehensive guide on navigating the IRS Tax Extension 2025: How to File Form 4868 for More Time. If you are stressed about filing taxes, read on to learn how to get an extension.

Let's face it, tax season can be a real beast. Juggling receipts, deciphering deductions, and making sure everything is accurate – it's enough to make anyone's head spin. But what if you could simply push pause for a bit? Filing for an extension using Form 4868 might just be the answer you're looking for. It gives you extra time to get your ducks in a row, ensuring accuracy and potentially saving you from costly mistakes down the road. Think of it as a safety net, giving you the space you need to tackle your taxes without the added pressure of a looming deadline.

So, who exactly is this guide for? Well, if you're feeling overwhelmed by the prospect of filing your taxes on time, or if you know you're going to need more time to gather all the necessary information, then you're in the right place. Maybe you're self-employed and dealing with complex income streams, or perhaps you've just been too busy to even think about taxes. Whatever the reason, this guide will walk you through the process of filing Form 4868, explaining the requirements, deadlines, and everything else you need to know to successfully request an IRS Tax Extension 2025.

In short, understanding the IRS Tax Extension 2025 and how to file Form 4868 is crucial for taxpayers who need more time to prepare their returns. It's not a free pass to skip paying, but a chance to avoid penalties by accurately filing later. Take advantage of this option if you need it; you're not alone, and it's often the wisest move. Remember, proper preparation is vital for a smooth tax season.

Understanding IRS Tax Extensions

What is a Tax Extension?

A tax extension gives you extra time to file your tax return. It's important to understand that an extension to file is not an extension to pay . You still need to estimate and pay your tax liability by the original deadline to avoid penalties and interest. Essentially, it's borrowing time to get your paperwork in order, not borrowing money from the IRS.

Who Should File for an Extension?

You might consider filing for an extension if:

You're waiting on important tax documents (like a K-1). You're self-employed and need more time to calculate your income and expenses. You experienced a significant life event (like a marriage, divorce, or birth of a child) that requires more time to sort out the tax implications. You simply need more time to gather your financial information and accurately prepare your return. You're dealing with a disaster or emergency that makes it difficult to file on time.

Common Misconceptions About Tax Extensions

A big misconception is that filing for an extension flags you for an audit. The IRS doesn’t automatically audit returns just because someone requested an extension. Also, many people think extensions mean they can pay their taxes later too. That’s a no-no! Estimated tax payments are still due on the original deadline.

How to File Form 4868: The Step-by-Step Guide

Filing Form 4868 to get your IRS Tax Extension 2025 isn't as scary as it sounds. It's actually quite straightforward. Here’s a breakdown:

Gathering Necessary Information

Before you start, gather these items:

Your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN). Your spouse's SSN or ITIN if you're filing jointly. Your address. An estimate of your total tax liability for the year. The amount you're paying with the extension request (if any).

Completing Form 4868

You can download Form 4868 from the IRS website. Here’s how to fill it out:

1. Part I – Identification: Enter your name, address, SSN (or ITIN), and your spouse's information if filing jointly.

2. Part II – Individual Income Tax: Enter your estimated total tax liability for the year. This is where that estimate from your financial records comes in handy. Remember, it's better to overestimate than underestimate!

3. Part III – Payments: Indicate how much you're paying with your extension request. If you’re paying electronically, you can skip this section for the form.

4. Signature: Sign and date the form.

Filing Options: Paper vs. Electronic

You have a few choices for submitting Form 4868:

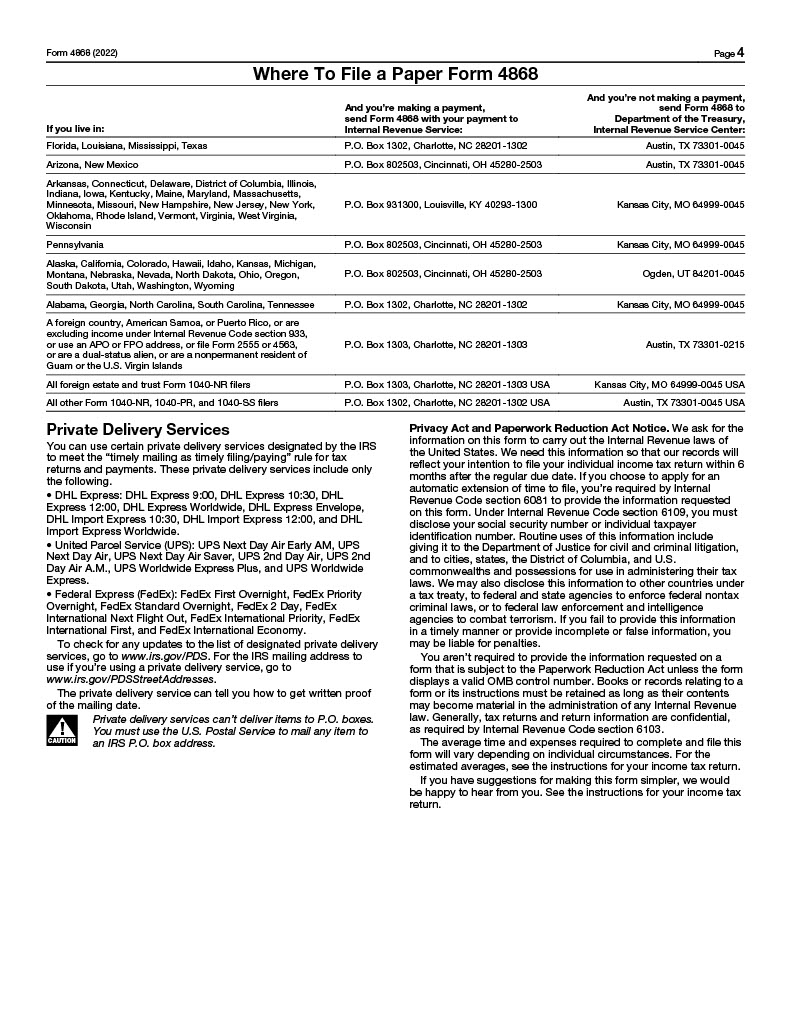

Paper Filing: Mail the completed form to the address listed in the Form 4868 instructions for your state. Electronic Filing: File online using IRS Free File or through a tax professional. Many tax software programs also offer electronic filing options.

Electronic filing is generally faster and more convenient, but paper filing works too. Choose the method that best suits you.

Deadlines and Important Dates for IRS Tax Extension 2025

The usual deadline for filing Form 4868 is the original tax filing deadline, which is typically April 15th. For the IRS Tax Extension 2025 , you'll need to file by April 15, 2025, to get an extension until October 15, 2025. Keep this date in mind!

Special Circumstances and Exceptions

U.S. Citizens Living Abroad: You may automatically get a two-month extension (until June 15) to file your return and pay any tax due. However, you still need to pay interest on any tax due from the original April deadline. Military Members: Members of the military on duty outside the U.S. may be eligible for an automatic extension of time to file.

Mistakes to Avoid When Filing for an Extension

Filing for an extension might seem straightforward, but it’s easy to slip up if you’re not careful. Here are common pitfalls and tips to dodge them:

Common Errors on Form 4868

Incorrect SSN or ITIN: Double-check these numbers! A typo can cause your extension request to be rejected. Inaccurate Estimated Tax Liability: Don't just pull a number out of thin air. Make a reasonable estimate based on your financial records. Missing Signature: Sounds simple, but it happens! An unsigned form is considered incomplete.

Forgetting to Pay Estimated Taxes

This is the big one! An extension gives you more time to file, not more time to pay. You still need to pay your estimated taxes by the original deadline.

How to Calculate and Pay Estimated Taxes

Review your prior year's tax return. Estimate your current year's income and deductions. Use Form 1040-ES (Estimated Tax for Individuals) to calculate your estimated tax liability. Pay online via IRS Direct Pay, by mail, or through a tax software program.

Ignoring the Extended Deadline

Once you get an extension, don't forget about the new deadline! Mark it on your calendar and give yourself plenty of time to prepare and file your return. The IRS Tax Extension 2025 extends your filing date to October 15, 2025.

Thinking an Extension Avoids Penalties Altogether

An extension only protects you from the failure-to-file penalty. You’ll still be hit with interest charges if you don’t pay your tax liability by the original deadline.

What Happens After You File for an Extension?

So, you’ve filed Form 4868 and snagged yourself an extension. Now what? It’s not time to kick back and relax completely! Here's what to expect and how to make the most of your extra time:

Confirmation and Acceptance of Extension

Generally, if you file Form 4868 on time and correctly, the IRS automatically grants your extension. You typically won't receive a confirmation notice unless there's a problem. If you file electronically, you'll usually get an immediate confirmation.

Using the Extra Time Wisely

This is your chance to get your taxes right! Don't waste it.

Gather All Necessary Documents: Organize your W-2s, 1099s, receipts, and any other relevant financial records. Review Your Deductions and Credits: Make sure you're claiming all the deductions and credits you're entitled to. This can significantly reduce your tax liability. Consider Professional Help: If you're feeling overwhelmed or have complex tax situations, consult a tax professional. They can provide valuable guidance and ensure you're filing correctly.

Filing Your Tax Return Before the Extended Deadline

You don't have to wait until the last minute to file your tax return! If you're ready before the extended deadline (October 15 for the IRS Tax Extension 2025 ), go ahead and file.

Potential Issues and How to Address Them

Rejected Extension Request: If your extension request is rejected (usually due to errors), correct the issues and refile as soon as possible. Inability to Pay: If you can't afford to pay your taxes, even with the extension, explore payment options like an installment agreement. Changes in Circumstances: If your income or deductions change significantly after filing for the extension, adjust your estimated tax liability accordingly.

Tax Extension and Self-Employed Individuals

If you're self-employed, tax season can feel like a never-ending saga. Juggling invoices, expenses, and estimated taxes can be overwhelming. That's where the IRS Tax Extension 2025 comes in handy. It’s especially beneficial for self-employed folks.

Why Self-Employed Individuals Benefit from Tax Extensions

More Time to Gather Records: As a freelancer or business owner, you probably deal with a ton of paperwork. An extension gives you the breathing room to organize everything and ensure accuracy. Complex Deductions: Self-employment comes with unique deductions (home office, self-employment tax, etc.). More time lets you properly calculate and claim these. Estimated Tax Payments: If your income fluctuates, estimating your tax liability can be tricky. An extension offers a chance to refine those estimates.

Specific Considerations for Self-Employed Taxpayers

Schedule C: When you eventually file, you'll likely need to complete Schedule C (Profit or Loss from Business). Make sure you have all the necessary information to accurately report your income and expenses. Self-Employment Tax: Don't forget to factor in self-employment tax (Social Security and Medicare). You'll need to calculate this using Schedule SE. Retirement Contributions: If you contribute to a self-employed retirement plan (SEP IRA, SIMPLE IRA, etc.), ensure you meet the contribution deadlines.

Resources and Tools for Self-Employed Taxpayers

IRS Website: The IRS offers a wealth of information and resources specifically for self-employed taxpayers. Tax Software: Many tax software programs cater to self-employed individuals, providing step-by-step guidance and automated calculations. Tax Professionals: A tax advisor specializing in self-employment can provide personalized advice and help you navigate complex tax issues.

Navigating IRS Penalties and Interest

Nobody wants to deal with penalties and interest, but it’s wise to know how they work so you can avoid them. Even with an IRS Tax Extension 2025 , you're not entirely off the hook if you don't play by the rules.

Understanding Failure-to-File vs. Failure-to-Pay Penalties

Failure-to-File Penalty: This penalty applies if you don't file your tax return by the original or extended deadline. The penalty is typically 5% of the unpaid taxes for each month or part of a month that your return is late, up to a maximum of 25%. Failure-to-Pay Penalty: This penalty applies if you don't pay your taxes by the original deadline, even if you file an extension. The penalty is usually 0.5% of the unpaid taxes for each month or part of a month that the taxes remain unpaid, up to a maximum of 25%.

How Interest is Calculated on Unpaid Taxes

Interest is charged on any unpaid tax from the original due date until the date you pay the tax. The interest rate can change, so check the IRS website for the most up-to-date information.

Strategies to Avoid or Minimize Penalties and Interest

File on Time (Even with an Extension): This one is obvious, but critical. Don't miss the extended deadline! Pay Estimated Taxes: Pay your estimated taxes throughout the year to avoid underpayment penalties. Request a Payment Plan: If you can't afford to pay your taxes in full, request an installment agreement. This allows you to pay off your balance over time. Seek Penalty Relief: If you have a valid reason for not filing or paying on time (e.g., illness, disaster), you may be eligible for penalty relief.

The Future of Tax Extensions: Trends and Predictions

Tax laws and procedures are constantly evolving, so let’s peer into the crystal ball and see what the future might hold for tax extensions.

Potential Changes to Form 4868

Streamlined Filing: The IRS could simplify Form 4868 to make it even easier to understand and complete. Increased Electronic Filing: The IRS may incentivize or even require electronic filing for extensions to improve efficiency and reduce errors. Enhanced Online Tools: Expect to see more user-friendly online tools for estimating tax liability and making payments.

Impact of Technology on Tax Filing

AI-Powered Tax Assistance: Artificial intelligence could play a bigger role in helping taxpayers understand their obligations and navigate the extension process. Automated Data Integration: Tax software may become even more integrated with financial institutions, automatically pulling in relevant data to streamline tax preparation. Blockchain for Tax Compliance: Blockchain technology could be used to securely track and verify financial transactions, making tax compliance more transparent and efficient.

Expert Predictions for the IRS Tax Extension 2025

Continued Emphasis on Electronic Filing: The IRS will likely continue to encourage electronic filing to reduce processing times and errors. Increased Scrutiny of High-Income Taxpayers: The IRS may focus more attention on high-income taxpayers who request extensions to ensure compliance. Potential for Legislative Changes: Tax laws are always subject to change, so keep an eye out for any legislative updates that could affect tax extensions.

FAQ: Your Tax Extension Questions Answered

Still have questions swirling around in your head? Let’s tackle some frequently asked questions about IRS Tax Extension 2025: How to File Form 4868 for More Time .

Basic Tax Extension Information

What is the purpose of filing Form 4868?

Filing Form 4868 grants you an extension of time to file your tax return. It doesn't extend the time to pay your taxes.

How much extra time does Form 4868 give you?

Filing Form 4868 typically gives you an additional six months to file your tax return.

Is there a fee to file for a tax extension?

No, there is no fee to file Form 4868 and request a tax extension.

Filing and Eligibility

Can anyone file for a tax extension?

Yes, generally anyone can file for a tax extension using Form 4868, regardless of their income or tax situation.

What happens if I file Form 4868 late?

If you file Form 4868 after the original tax filing deadline, your extension request will likely be denied, and you may be subject to penalties.

Can I revoke a tax extension after filing it?

No, you cannot revoke a tax extension once it has been filed. However, you can still file your tax return before the extended deadline.

Payment and Penalties

Does filing a tax extension prevent penalties and interest?

Filing a tax extension only prevents the failure-to-file penalty. You'll still be charged interest on any unpaid taxes from the original deadline.

What if I can't afford to pay my taxes even with an extension?

If you can't afford to pay your taxes, explore payment options like an installment agreement or offer in compromise.

How do I pay my taxes when filing for an extension?

You can pay your taxes electronically via IRS Direct Pay, by mail with a check or money order, or through a tax software program.

Special Situations

What if I live abroad?

U.S. citizens living abroad may automatically receive a two-month extension to file their return.

What if I'm a member of the military?

Members of the military may be eligible for special extensions or tax benefits.

Where can I find Form 4868 and instructions?

You can download Form 4868 and instructions from the IRS website or obtain them from a tax professional.

Tax season doesn't have to be a source of dread. Understanding the IRS Tax Extension 2025 and how to file Form 4868 is like having a secret weapon in your tax arsenal. It gives you the power to take control of your finances, avoid unnecessary stress, and ensure that you're filing accurately and on time. It's about being proactive, responsible, and taking the necessary steps to avoid penalties and interest. So, if you find yourself needing more time to tackle your taxes, don't hesitate to file for an extension.